Feie Calculator for Beginners

Table of ContentsNot known Details About Feie Calculator What Does Feie Calculator Do?Feie Calculator Fundamentals ExplainedThe smart Trick of Feie Calculator That Nobody is Talking AboutA Biased View of Feie Calculator

Initially, he marketed his united state home to establish his intent to live abroad completely and made an application for a Mexican residency visa with his better half to aid accomplish the Authentic Residency Examination. Furthermore, Neil secured a long-lasting building lease in Mexico, with strategies to ultimately acquire a property. "I presently have a six-month lease on a residence in Mexico that I can prolong another six months, with the purpose to purchase a home down there." However, Neil explains that buying building abroad can be challenging without first experiencing the area."We'll certainly be outside of that. Also if we come back to the US for medical professional's visits or service calls, I doubt we'll invest greater than one month in the US in any kind of given 12-month duration." Neil stresses the significance of strict tracking of united state gos to (Form 2555). "It's something that individuals need to be truly attentive regarding," he claims, and encourages expats to be careful of usual mistakes, such as overstaying in the U.S.

Feie Calculator Can Be Fun For Everyone

tax obligation responsibilities. "The reason that U.S. tax on worldwide revenue is such a large bargain is because many individuals forget they're still subject to united state tax obligation also after relocating." The united state is just one of the few countries that tax obligations its citizens no matter where they live, suggesting that also if an expat has no revenue from united state

income tax return. "The Foreign Tax obligation Credit report allows people functioning in high-tax nations like the UK to offset their U.S. tax obligation responsibility by the quantity they've currently paid in tax obligations abroad," states Lewis. This makes certain that expats are not strained twice on the very same revenue. Nevertheless, those in low- or no-tax countries, such as the UAE or Singapore, face additional difficulties.

Feie Calculator for Dummies

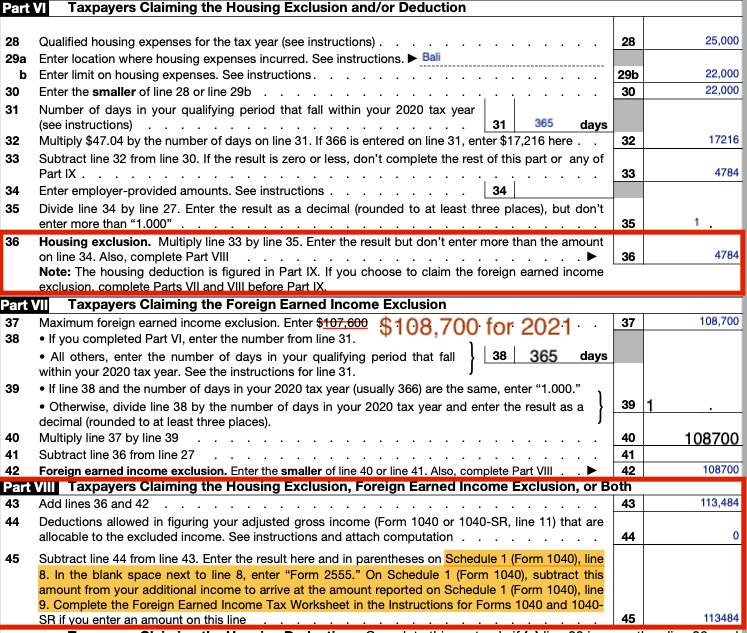

Below are several of the most frequently asked concerns concerning the FEIE and various other exclusions The International Earned Earnings Exclusion (FEIE) allows united state taxpayers to exclude approximately $130,000 of foreign-earned earnings from federal income tax, lowering their U.S. tax obligation. To get approved for FEIE, you must satisfy either the Physical Existence Examination (330 days abroad) or the Authentic House Examination (confirm your key residence in an international nation for a whole tax obligation year).

The Physical Presence Test needs you to be outside the united state for 330 days within a 12-month period. The Physical Existence Test likewise requires united state taxpayers to have both a foreign revenue and a foreign tax obligation home. A tax obligation home is specified as your prime location for company or work, regardless of your family's residence.

The Greatest Guide To Feie Calculator

An income tax obligation treaty between the united state and one more nation can help prevent dual taxes. While the Foreign Earned Earnings Exemption decreases gross income, a treaty may offer added advantages for eligible taxpayers abroad. FBAR (Foreign Checking Account Report) is a needed declare U.S. citizens with over $10,000 in international monetary accounts.

Eligibility for FEIE depends on conference certain residency or physical visibility tests. is a tax consultant on the Harness platform and the creator of Chessis Tax. He belongs to the National Association of Enrolled Agents, the Texas Culture of Enrolled Brokers, and the Texas Society of CPAs. He brings over a decade of experience helping Big 4 companies, suggesting expatriates and high-net-worth individuals.

Neil Johnson, CPA, is a tax consultant on the Harness platform and the founder of The Tax obligation Man. He has over thirty years of experience and now concentrates on CFO solutions, equity payment, copyright taxation, marijuana tax and divorce associated tax/financial planning matters. He is a deportee based in Mexico - https://www.bunity.com/feie-calculator.

The foreign earned income exemptions, occasionally described as the Sec. 911 exemptions, exclude tax on incomes gained from working abroad. The exemptions consist of 2 components - a revenue exclusion and a real estate exclusion. The complying with Frequently asked questions talk about the benefit of the exclusions including when both spouses are deportees in a basic way.

Facts About Feie Calculator Uncovered

The tax obligation benefit leaves out the earnings from tax at bottom tax prices. Formerly, the exemptions "came off the top" lowering revenue subject to tax at the leading tax obligation sites prices.

These exclusions do not excuse the incomes from United States taxes but simply provide a tax decrease. Keep in mind that a single person functioning abroad for all of 2025 that made regarding $145,000 with no various other income will certainly have gross income lowered to no - properly the very same response as being "free of tax." The exclusions are calculated daily.